© 2024 ICFXL Ltd. Copyright - All Rights Reserved

Risk warning: There is a significant degree of risk involved in trading leveraged financial products, such as futures, CFDs, and forex. This type of trading may not be appropriate for all investors. Losses from trading in these financial products may surpass your initial investment. Before dealing in such financial products, you should carefully examine your degree of experience, risk tolerance, and investment objectives. It is your duty to make sure you are completely aware of the dangers and, if needed, to obtain independent legal counsel. You affirm and guarantee that you are at least eighteen years old and possess the mental ability necessary to engage in legally binding contracts by using our website.

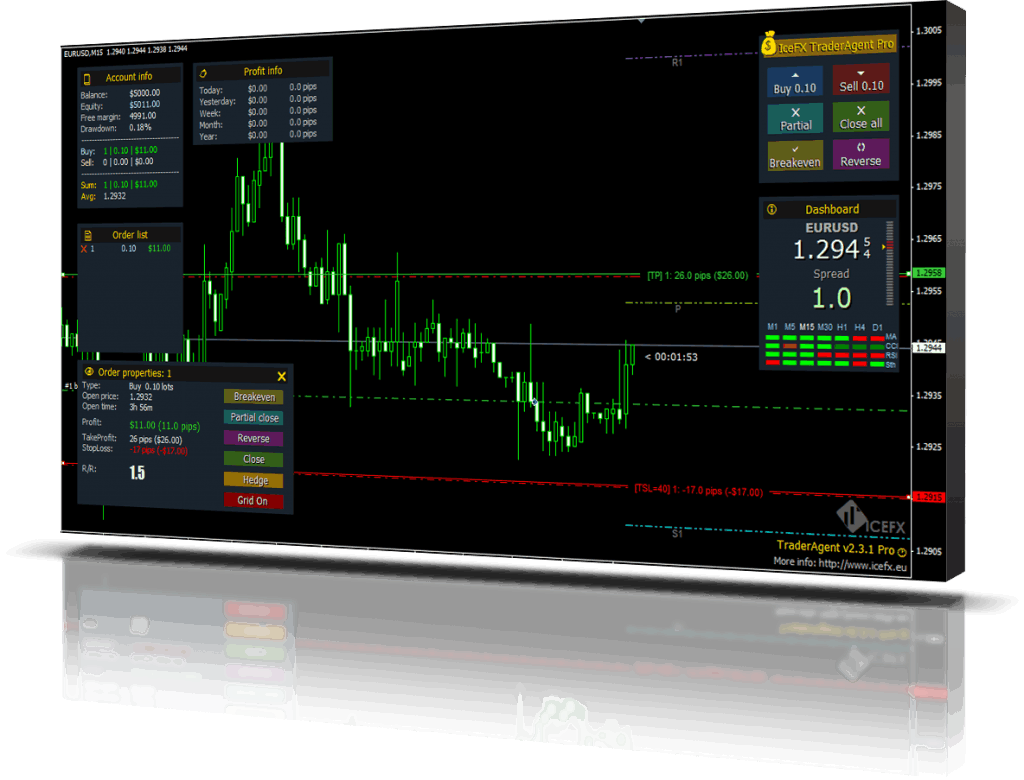

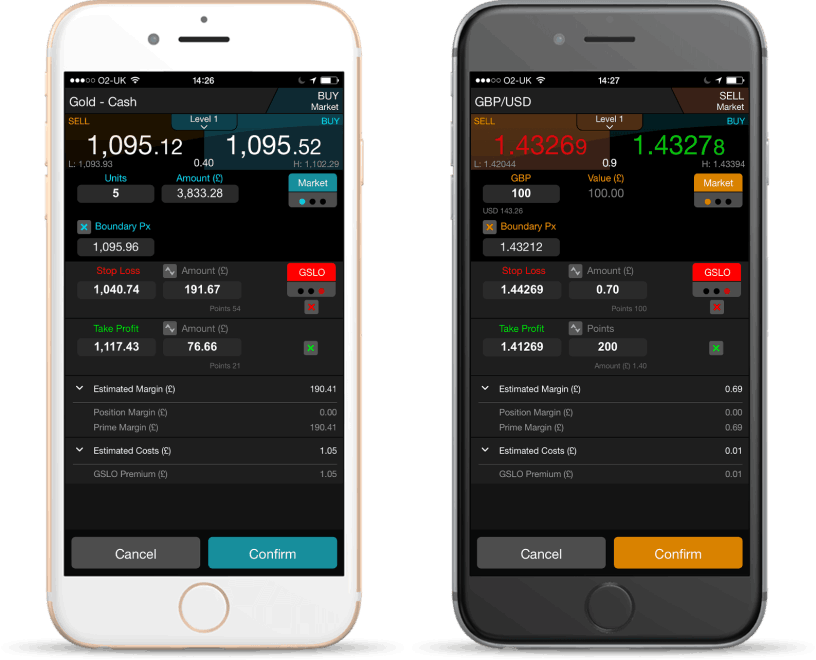

Trading: The ICFXL platform allows users to trade a range of financial assets, such as indices, commodities, and currencies. Please remember that trading entails risk, and you should never invest money you cannot afford to lose.

Complaints: Please get in touch with our customer service staff right away if you have any concerns or complaints. Our goal is to address your problem as quickly as we can and in a fair amount of time.

Client funds: We maintain client funds with respectable institutions in separate accounts.. In the unlikely case of our insolvency, your money will be safeguarded since they are maintained apart from our own operational funds.

Privacy Policy: We value your privacy and are dedicated to safeguarding your personal information. Your personal information is collected, used, and protected in accordance with our privacy policy. Please carefully review our privacy policy before entrusting us with any personal data.

Terms and Conditions: You accept our terms and conditions, which regulate how you use our services, by using our website. Before using our website, please carefully read our terms and conditions.

Risk Disclosure: Future outcomes cannot be predicted based on past performance. Our website's content is offered solely for informative reasons; it is not intended to be interpreted as financial advice. Prior to making any investing decisions, you should consult an independent advisor. Afghanistan, Belarus, Burma, Burundi, Central African Republic, China, Congo, Cuba, Egypt, Guinea, Guinea-Bissau, Iraq, Iran, Indonesia, Lebanon, Lesotho, Libya, Malaysia, Maldives, Mali, Moldova, Nicaragua, Nigeria, North Korea, Pakistan, Russia, Somalia, Sudan, South Sudan, Syria, Tunisia, Turkey, Vanuatu, Venezuela, Yemen, and Zimbabwe are among the countries from which ICFXL does not accept their clients. At its own discretion, ICFXL may reject any candidate from any jurisdiction without having to provide a justification.

Contact Us: For any enquiries or worries regarding our offerings, do reach out to us at [support@icfxl.com]. Our customer service staff is here to help you around the clock.

UK, UAE, Singapore, South Africa, London,, Dubai, India - Chennai, Coimbatore, Mumbai, Bangalore, Vellore, and Kochi.